More Information

Submitted: January 02, 2025 | Approved: February 04, 2025 | Published: February 05, 2025

How to cite this article: Lee H. The Limitation of Determination Structure of the Agreed Rate of Return for Public-Private Partnership (PPP) Road Projects and Improvement in South Korea. Arch Case Rep. 2025; 9(2): 051-053. Available from:

https://dx.doi.org/10.29328/journal.acr.1001127

DOI: 10.29328/journal.acr.1001127

Copyright license: © 2025 Lee H. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Keywords: Rehabilitation; Vocal apparatus; Voice quality; Larynx; Acoustic analysis

The Limitation of Determination Structure of the Agreed Rate of Return for Public-Private Partnership (PPP) Road Projects and Improvement in South Korea

Hyejin Lee*

Associate Research Fellow, Korea Transport Institute, South Korea

*Address for Correspondence: Hyejin Lee, Associate Research Fellow, Korea Transport Institute, South Korea, Email: [email protected]

Public-Private Partnership (PPP) road projects are being promoted worldwide to encourage road investments; however, research on the appropriate rate of return for these projects is insufficient. This is likely because the return on investment for PPP road projects is determined through negotiations between the government and the private sector, a process that remains confidential. The rate of return for PPP road projects is not only a key indicator for evaluating project performance but also a potential driver for future government financial subsidies. Therefore, research on the appropriate rate of return for PPP road projects is necessary for the sustainability of these projects.

This study, based on the concept that both the government and the private sector share the anticipated risks of the project, quantifies six types of risks and proposes a model for predicting the appropriate rate of return. The model is able to explain approximately 68% of the cases in South Korea’s PPP road projects. The risk with the greatest influence on the rate of return was found to be an economic risk, while the least influential was regulation change risk.

Due to the confidentiality of data related to PPP road projects, this study only utilized 54 cases from South Korea. It is hoped that a wider range of data will be collected and further research on the appropriate rate of return will continue to enhance the sustainability of PPP road projects.

Public-Private Partnership (PPP) road projects have emerged as a significant model to alleviate financial burdens on governments while enhancing infrastructure development in South Korea. Despite their numerous trials and history, there are unclear points to determine the agreed rate of return for public-private partnership road projects. This paper explores the key challenges in the current determination structure of projects and suggests potential measures.

Key challenges in determination for the agreed rate of return

- Risk and agreed rate of return: Many previous studies emphasize that the higher the risk of a project, the higher the rate of return should be set [1-3]. While this principle provides a foundational guideline, it has often been overlooked in previous projects. This oversight is primarily due to the lack of clear metrics for assessing various risk factors, including economic, social, and financial risks [4-6].

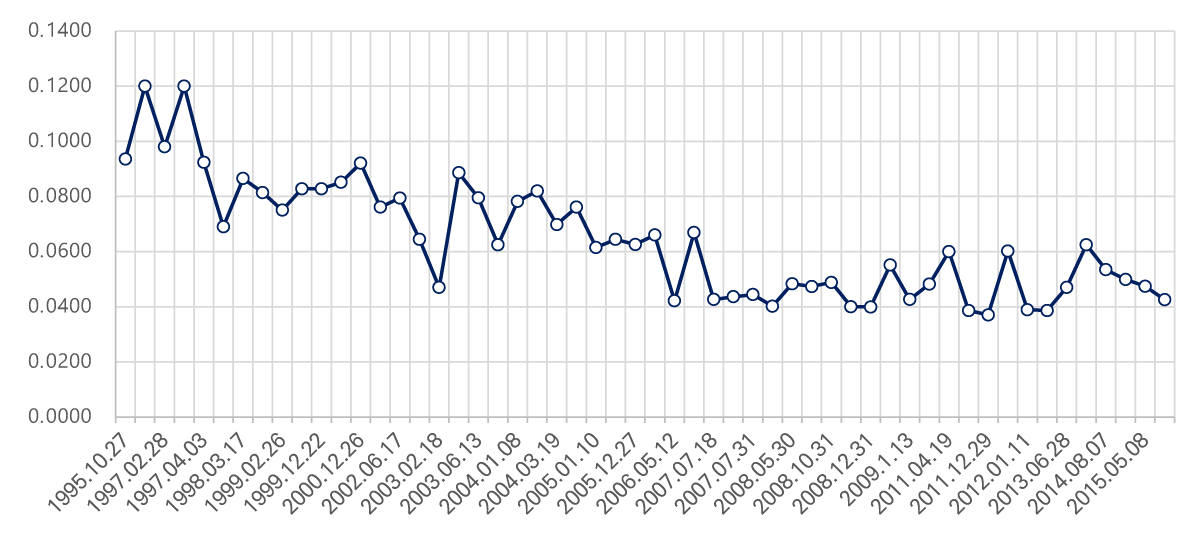

- Over-reliance on the rate of return levels from previous projects: In South Korea's Basic Plan for Private Investment Projects, the rate of return is determined by referencing the levels of similar projects during the implementation process, based on institutional and statutory plans. As a result, project returns have gradually declined since they are calculated using historical data rather than reflecting current market conditions or operational characteristics. For instance, the rate of return for road projects has steadily decreased from 12% - 9% to 6% - 4%, as shown in Figure 1. This approach can lead to suboptimal outcomes and discourage innovation in project structuring.

- Limited risk-sharing reflection: When the private sector bears a greater share of project risks, the project's rate of return should be set higher. Conversely, as the government or public authority takes on more of these risks, the project's rate of return will decrease [7]. However, there is currently no clear metric to measure this balance. Therefore, a structured framework for determining rates of return that reflects the risk-sharing arrangement between the competent authority and the project operator is urgently needed. It is also important to clarify the negotiation process between the private sector and the government, enabling them to make informed decisions regarding future uncertainties [8-11].

Figure 1: Trends in the rate of return levels on Public-Private Partnership (PPP) Road Projects.

The correlation between the basic collected data of PPP road projects and the rate of return in South Korea was identified through robust regression analysis. Robust regression, one of the methods of regression analysis, reduces the influence of outliers or extreme values and allows for a more accurate analysis of the relationship between independent and dependent variables. In robust regression models, the value of R-squared may be somewhat lower, but this ensures that the model is not distorted by outliers. Additionally, the coefficients of the independent variables from robust regression analysis are generally regarded as more stable [12].

New structure for the determination of the agreed rate of return in PPP road projects

Previous papers also suggested influence risk for pre-evaluating the Feasibility of PPP projects [13]. This paper developed the equation for determining the agreed rate of return in PPP road projects by Robust Regression Model. This is based on the 5 risk groups, which means higher the agreed rate of return. This equation was established by 54 PPP road project cases. The basic statistical analysis results are presented in Table 1.

| Table 1: Basic Statistical Analysis. | |||||

| Risk group | Independent variables | Min | Average | Max | Standard Deviation |

| Economic risk | Additional Yield Compared to Long-term Treasury Bonds in Previous Projects | -0.0318 | 0.4062 | 1.3863 | 0.5340 |

| Regulation change risk | The number of amendments to the concession agreement in previous projects | 0.0000 | 0.8706 | 1.1500 | 0.3219 |

| Travel demand risk | Risk Sharing Ratio of the Project Operator | 0.0000 | 0.4617 | 1.0000 | 0.3550 |

| Construction Risk | Ratio of Tunnel and Bridge Length to Total Length (%) | 0.0000 | 0.4884 | 1.0000 | 0.3133 |

| Operation Risk | Corporate Tax Rate at the Time of Concession Agreement Signing (%) | 0.200 | 0.258 | 0.300 | 0.3332 |

| Decision-making Risk | Three-Year Target Toll Revenue Achievement Rate (%) of the Previous Project | 0.0000 | 0.0613 | 0.1200 | 0.0240 |

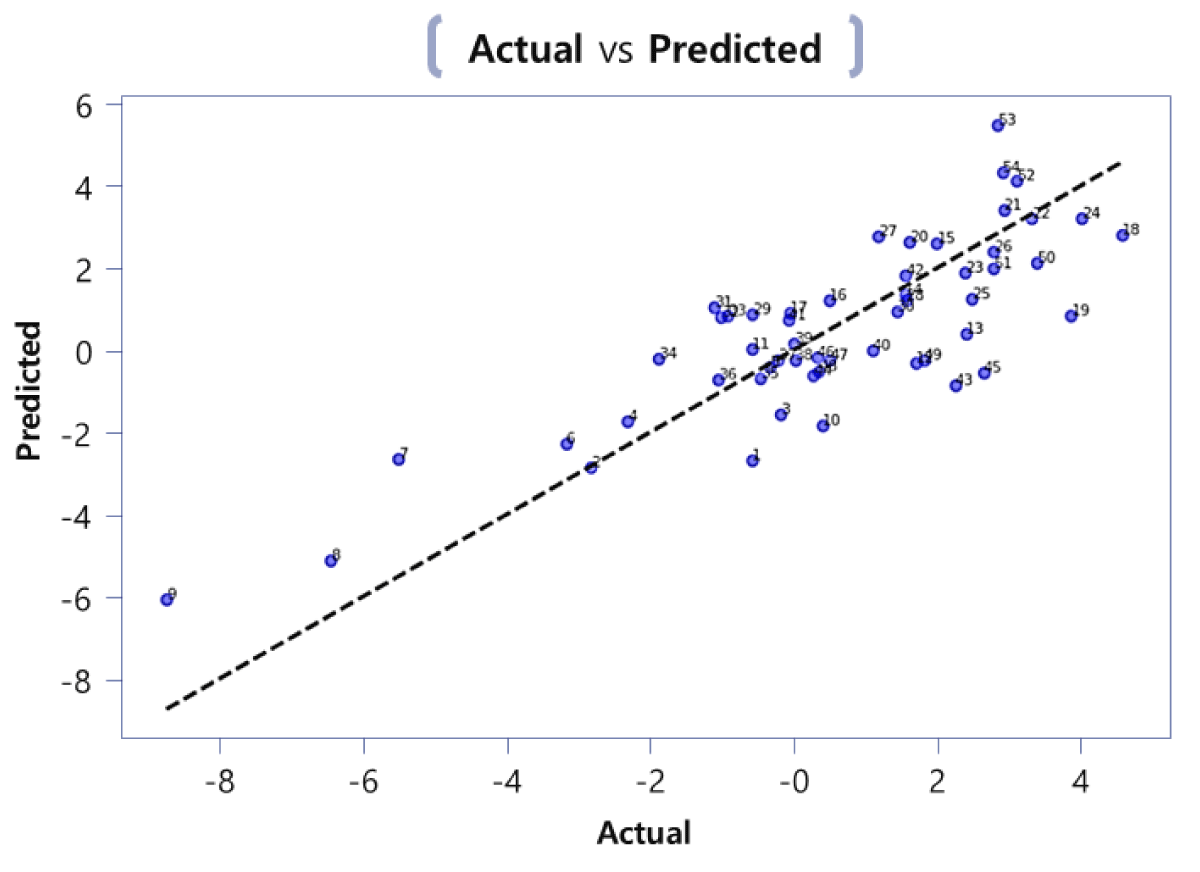

The predicted values from the model and the actual values are shown in Figure 2 as an upward trend. This equation was developed using robust regression analysis and explains approximately 67% of actual cases shown in Table 2. Among the six risk groups, the most influential factor was economic risk (0.622), as shown in Table 3. The factor with the lowest influence is regulation change risk (0.003).

Figure 2: Robust Regression Model Results Scatter Plot.

| Table 2: Coefficient of Determination of Robust Regression Analysis. | |||

| R-squared | 0.678 | Adj. R-squared | 0.641 |

| Table 3: Coefficient of Determination of Robust Regression Analysis. | ||||

| Risk group | Measurement | Coefficient | Standard Deviation |

z-value |

| Economic risk | Additional Yield Compared to Long-term Treasury Bonds(10 years) in Previous Projects | 0.622 | 0.000 | 0.000 |

| Regulation change risk | The number of amendments to the concession agreement in previous projects | 0.003 | 0.003 | 0.027 |

| Travel demand risk | Risk Sharing Ratio of the Project Operator | 0.025 | 0.005 | 0.000 |

| Construction Risk | Ratio of Tunnel and Bridge Length to Total Length (%) | 0.013 | 0.005 | 0.009 |

| Operation Risk | Corporate Tax Rate at the Time of Concession Agreement Signing (%) | 0.241 | 0.050 | 0.000 |

| Decision-making Risk | Three-Year Target Toll Revenue Achievement Rate (%) of the Previous Project | 0.015 | 0.006 | 0.015 |

This paper proposes a new determination structure for setting the rate of return on PPP road projects. Based on data from actual cases in South Korea, this model aims to enhance risk assessment, strengthen institutional oversight, and promote diverse project frameworks.

There is a significant gap in determining the appropriate rate of return. This is mainly because it has historically been determined through negotiations between the government and the private sector. However, the rate of return for PPP road projects is not only a key indicator for evaluating project performance but also a potential driver for future government financial subsidies. This aspect emphasizes the need for further research in determining the appropriate rate of return.

The model presented in this paper is slightly biased toward economic risk, as economic risk is more quantifiable compared to other independent variables, such as regulation change risk. Additionally, due to limitations in the available data, only one independent variable was selected per risk group. Future research could expand this by incorporating multiple independent variables. It is hoped that further studies on the rate of return for PPP road projects will continue to achieve a more balanced and effective approach. These efforts will not only increase the attractiveness of PPP projects to private investors but also ensure more equitable outcomes for the government.

- World Bank Public-Private Partnership Resource Center. PPP Reference Guide - PPP Cycle. 2017. Available from: https://ppp.worldbank.org/public-private-partnership/library/ppp-reference-guide-ppp-cycle

- Bonzanigo L, Kalra N. Making Informed Investment Decisions in an Uncertain World. Policy research working paper 6765, The World Bank. 2014. Available from: https://ideas.repec.org/p/wbk/wbrwps/6765.html

- Checherita C, Gifford J. Risk sharing in public-private partnerships: General considerations and an evaluation of the US practice in road transportation. 2007. Available from: https://ageconsearch.umn.edu/record/207820/?v=pdf

- Akerlof GA. The Market for "Lemons": Quality Uncertainty and the Market Mechanism. Q J Econ. 1998; LXXXIV(3):488-500. Available from: https://www.jstor.org/stable/1879431

- Daniel K. Thinking, fast and slow. Farrar, Straus and Giroux. 2017.

- De Dreu CK, Carnevale PJ. Motivational bases of information processing and strategy in conflict and negotiation. 2003. Available from: https://psycnet.apa.org/doi/10.1016/S0065-2601(03)01004-9

- Alghamdi F, Tatari O, Alghamdi L. Enhancing the decision-making process for public-private partnerships infrastructure projects: A socio-economic system dynamic approach. J Eng Appl Sci. 2022;69(1). Available from: https://jeas.springeropen.com/articles/10.1186/s44147-022-00117-0

- De Dreu CK, Harinck F, Van Vianen AE. Conflict and performance in groups and organizations. 1999. Available from: https://www.scirp.org/reference/referencespapers?referenceid=2400994

- Emmett RB. Reconsidering Frank Knight’s risk, uncertainty, and profit. The Independent Review. 2020;24(4). Available from: https://www.independent.org/pdf/tir/tir_24_4_06_emmett.pdf

- Fisher R, Ury WL, Patton B. Getting to yes: Negotiating agreement without giving in. Penguin; 2011. Available from: https://digitalcommons.usu.edu/unf_research/47/

- Lempert RJ. Shaping the next one hundred years: New methods for quantitative, long-term policy analysis. 2003. Available from: https://www.rand.org/content/dam/rand/pubs/monograph_reports/2007/MR1626.pdf

- Hamilton LC. Regression with Graphics: A Second Course in Applied Statistics. 1991.

- Ika Wahyuni P, Hardjomuljadi S, Sulistio H. Model Influence Risk and Incentive Variables on the Feasibility of Public-Private Partnership (PPP) in Highway Infrastructure Projects. Int J Civ Eng Technol. 2019;10(8). Available from: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3450312